£34.4 billion in sales lost due to

e-commerce basket abandonment every year in the UK.

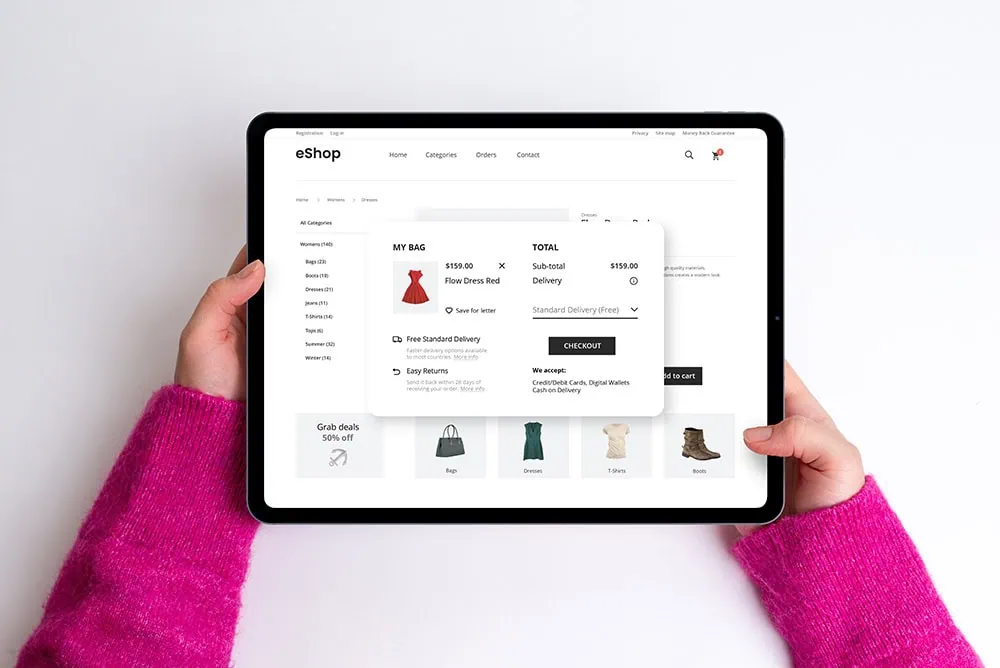

In today’s volatile retail landscape, UK retailers are losing a staggering £34.4 billion annually to e-commerce basket abandonment – an increase of £2.9 billion on 2023.

Incisive research by ILG company GFS in partnership with Retail Economics, delves into today’s era of zero-tolerance and explores the psychological triggers behind abandoned carts across UK online retail. It reveals how customers’ purchasing decisions are made meticulously, and influenced by factors such as economic confidence and rapid technological changes. Today, both delivery and returns are indispensable aspects of the online shopping experience, and not mere conveniences.

Why does basket abandonment matter?

Reducing basket abandonment is critical to retail brands for four key reasons:

- Lost revenue: Every abandoned basket is a lost sale

- Higher customer acquisition costs: Failure to convert undermines the return on marketing investment

- Re-targeting costs and loyalty erosion: Re-targeting customers requires resource to re-engage, adding to operational costs and eroding loyalty

- Brand damage: Negative delivery experiences damage brand reputation

Top delivery factors impacting basket abandonment

27% of baskets are abandoned due to lack of delivery options!

The research examines the top drivers of basket abandonment in 2024. With delivery factors playing such a key and growing role in the purchase experience, the survey reveals why consumers stop their orders at checkout stage, and compares 2024 with 2023 data. Common causes include frustration with delivery charges, lack of delivery choice, or an expectedly long wait for delivery. Alarmingly, 27% of abandoned baskets are triggered by the shopper’s ‘increased dissatisfaction with choice of delivery options’!

Tackling basket abandonment with a trusted partner

Working with trusted fulfilment and delivery partners like ILG and GFS empowers brands to conquer these checkout challenges. We help brands to drive online sales, by winning customer loyalty and overcoming their logistical issues. Our managed multi-carrier delivery services provide benefits such as a portfolio of world-class carriers, highly competitive pricing and hands-on guidance from expert delivery teams to despatch your products worldwide. All this helps you stay ahead of rapidly escalating consumer expectations and provides the choice, value and quality your customers expect – to keep them purchasing from you again and again.

Key insights:

- 51% of consumers say choice matters more than cost of delivery

- 80% of shoppers would consider paying extra for premium delivery

- 54% of consumers are willing to pay for hassle-free returns

- 75% of the most affluent shoppers abandon baskets due to insufficient delivery options

Key spenders such as younger and more affluent shoppers are grappling from financial strain. They have become more discerning in their preferences, in search for greater value with delivery and returns options that suit their varying needs. This has seen choice of delivery services remain critical over cost, with high-frequency online shoppers demanding a broad array of options to avoid basket abandonment or switching to other retailers who meet their needs across product categories.

Strategies for tackling basket abandonment

Getting delivery strategies right can represent low-hanging fruit in retailers’ efforts for satisfaction and loyalty, with over three-quarters (78.4%) of shoppers saying they’d return to a retailer following positive delivery experiences.

1. Simplifying with a single multi-carrier partner

Switching from multiple delivery partners to a single multi-carrier partner simplifies the ability to offer maximum choice and convenience of delivery options to shoppers, with the advantage of competitive rates through aggregated parcel volumes. However, caution is required as not all multi-carrier delivery partners are equal. Look for partners that offer proactive oversight of carrier performance, to mitigate risk and ensure consistency of service to end customers.

2. The ‘rule of five’ for delivery options

Offering a minimum of five delivery options (next-day, nominated day, standard delivery, click-and-collect, and alternative pick-up points) can significantly minimise abandonment. This strategy meets the diverse demands of online shoppers, promoting a customer-centric approach. Effective implementation relies on sophisticated logistics, including multi-carrier partnerships and advanced delivery management systems, ensuring a seamless, personalised shopping experience that enhances both customer satisfaction and loyalty.

3. Reliability and transparency non-negotiable

Fulfilling delivery promises is crucial for maintaining brand reputation and customer loyalty. Retailers must integrate flexibility and contingency into their operations to sustain reliable delivery services. Transparent communication about order status and potential delays builds customer trust. Continuously refining delivery processes, pre-empting issues with proactive tracking, and maintaining robust partnerships with dependable logistics providers are essential for upholding delivery reliability and fostering long-term customer relationships.

4. Tech ahead: Leverage innovation

For retailers, leveraging data science and AI can deliver improved demand prediction, optimised inventory levels, and more efficient delivery routes. Investing in emerging technology like AI could, in time, exacerbate the divide between retailers who embrace it, and those that do not.

Differences are likely to emerge across processes and operations that ultimately shape frictionless experiences for shoppers.

For consumers (particularly the under-45s), many are receptive to technology that addresses pain points and enhances the online shopping experience. Innovations that appeal to digital natives include: new payment services, personalised recommendations, visualisation tools (e.g. virtual fitting rooms, furniture placement), and AI assistants.

Currently, consumer interest in AI assistance is less than 1 in 3 (receiving delivery order updates (32.3% would be interested), managing returns (28.9%), and answering general queries (25.7%)).

5. Returns done right = repeat business won

A balanced approach to both outbound deliveries and inbound returns is critical for a comprehensive delivery strategy. Hassle-free returns and quick refunds are essential to meet customer expectations and encourage repeat business. This is particularly crucial undercurrent economic conditions where consumers value quick refunds to support finances.

Applying consistent standards throughout all phases of the delivery and returns process ensures a smooth end-to-end experience that builds loyalty and encourages repeat purchases.

Tackling basket abandonment with a trusted partner

Working with a trusted fulfilment and delivery partner like ILG empowers brands to conquer these checkout challenges. We help brands to drive online sales, by winning customer loyalty and overcoming their logistical issues. Our managed multi-carrier delivery services provide benefits such as a portfolio of world-class carriers, highly competitive pricing and hands-on guidance from expert delivery teams to despatch your products worldwide. All this helps you stay ahead of rapidly escalating consumer expectations and provides the choice, value and quality your customers expect – to keep them purchasing from you again and again.

Find out how your business could benefit from a multi-carrier delivery partner like ILGResearch Methodology

Consumer surveys were undertaken in March 2024 to gather answers from a sample of 2,000 nationally representative UK households. Economic modelling and retail sales forecasts are based on proprietary Retail Economics data and official national statistics.

Contact Us

More insights >

A Guide to UK Market Entry for Canadian Brands

Canada’s traditional export routes have been radically changed recently and the UK market could be a good alternative to the US. Read our guide to UK market entry.

ILG Partners with Fin – Sustainable Logistics

ILG is thrilled to announce its new partnership with Fin Sustainable Logistics, a pioneer in zero-emissions delivery services.